How to Adjust an Entry for Unearned Revenue

If the total wages for the 4 Fridays in June are $1000.00 ($250.00 per week or $50.00 per day), “Imaginary company Ltd.” will make routine journal entries for wage payments at the end of each week. As the company pays wages it increases the ‘Wage Expense’ account and decreases the ‘Cash’ account. In this example, “Imaginary company Ltd.” would pay wages on the 5th, 12th, 19th, and 26th of June.

Accrued Expenses

To make them zero we want to decrease the balance or do the opposite. We https://www.bookstime.com/ will debit the revenue accounts and credit the Income Summary account.

It’s possible for a company to generate revenue but have a net loss. Penney suffered a loss on the bottom line of $116 million, despite earning $12.5 billion in revenue. The loss occurs typically when debts or expenses outstrip earnings, as in the case of J.C. For example, with a shoe retailer, the money it makes from selling shoes before accounting for any expenses is its revenue.

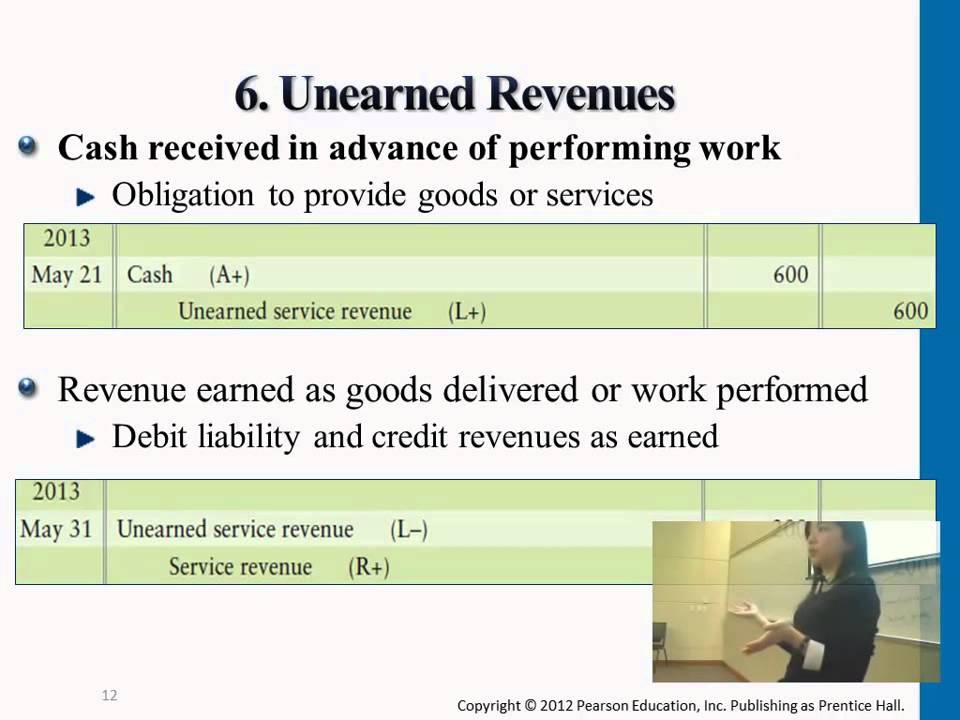

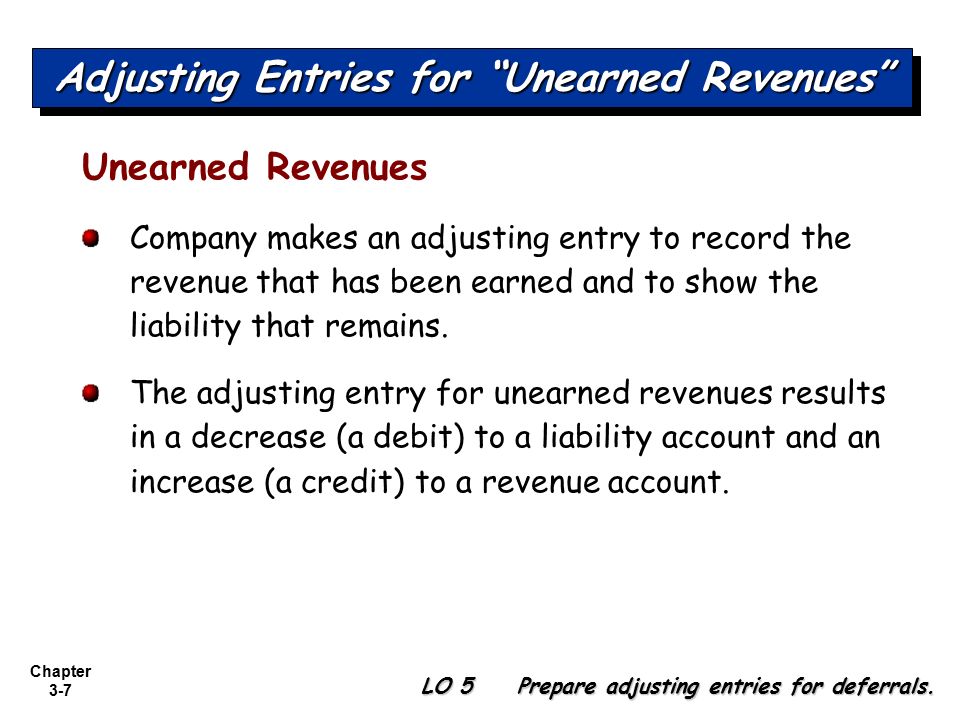

Unearned Income Journal Entry

The entire $3,000 goes into the Unearned Revenue account because you’ve been paid for work you have not yet completed. Unearned revenue is valued because it provides cash flow to the business providing the products or services.

An example of unearned revenue might be a publishing company that sells a two-year subscription to a magazine. The liability arises from the fact that the company has collected money for the subscription but has not yet delivered the magazines.

Below, we go into a bit more detail describing each type of balance sheet item. AccountDebitCreditCash AccountXAccrued Liability AccountXWhen the original entry is reversed (showing you paid the expense), it’s removed from the balance sheet. DebitCreditCash10,000Accounts https://www.bookstime.com/articles/is-unearned-revenue-a-current-liability Receivable25,000Interest Receivable600Supplies1,500Prepaid Insurance2,200Trucks40,000Accum. The journal entry to recognize a deferred revenue is to debit or increase cash and credit or increase a deposit or another liability account.

- It’s easy to read definitions of what concepts are, but you can understand them better by relating them to practical examples.

- Accounting reporting principles state that unearned revenue is a liability for a company that has received payment (thus creating a liability) but which has not yet completed work or delivered goods.

- The journal entry is to debit or increase interest receivable, an asset account, and to credit or increase interest revenue, which is reported in the income statement.

- The credit to the unearned revenue account is a balance sheet liability indicating that the business has an obligation to provide the customer with services.

- Accrued revenue is quite common in the services industries, since billings may be delayed for several months, until the end of a project or on designated milestone billing dates.

- Two important parts of this method of accounting are accrued expenses and accrued revenues.

Disclose current liabilities under the liabilities section on the balance sheet first. Note that most organizations prefer to list notes payable and accounts payable at the top. Other account classifications are then typically listed in the order of their amount, from high to low. Assuming that the airline accumulates only $1,000 worth of unearned revenue and it is all classified as current, the balance sheet would reflect a category of unearned revenue for $1,000 under current liabilities. When payment is due, and the customer makes the payment, an accountant for that company would record an adjustment to accrued revenue.

Revenue is the total amount of income generated by the sale of goods or services related to the company’s primary operations. Profit, typically called net profitor the bottom line, is the amount of income that remains after accounting for all expenses, debts, additional income streams and operating costs. The most common method of accounting used by businesses is accrual-basis accounting. Two important parts of this method of accounting are accrued expenses and accrued revenues.

Because it is money you possess but have not yet earned, it’s considered a liability and is included in the current liability section of the balance sheet. In February, after you complete the second month’s worth of work, you can then take $1,000 of the unearned revenue and claim it as revenue. After you have fulfilled your obligations in March, the unearned revenue account is zeroed out because you have finally earned the entire amount you were paid.

To reverse the transaction, debit the accrued liability account. To record accrued expenses, use debit and credit journal entries.

A liability account that reports amounts received in advance of providing goods or services. When the goods or services are provided, this account balance is decreased and a revenue account is increased. In accounting, accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out. A liability is defined as a company’s legal financial debts or obligations that arise during the course of business operations. At the end of the first quarter of 2019, Morningstar had $233 million in unearned revenue, up from $195.8 million from the prior year period.

The line item “Unearned Revenue” or “Deferred Income” gives the company a place to recognize that the cash payment has come in but the company has deferred the revenue recognition until a later date. Accounts payable is the total amount of short-term obligations or debt a company has to pay to its creditors for goods or services bought on credit.

This documentation can include bank statements, receipts, copies of checks and purchase orders that show funds you have received but not yet earned. Many businesses receive advance payment for products and services.

Routine and recurring Accrued Liabilities are types of transactions that occur as a normal, daily part of the business cycle. Infrequent or non-routine Accrued Liabilities are transactions that do not occur as a daily part of the business cycle, are unearned revenues liabilities but do happen from time to time. to record unearned revenue liability at the time of sale of tickets. Image from AmazonBalance Sheet – Check out CFI’s Advanced Financial Modeling & Valuation Course for an in-depth valuation of Amazon.

Accrued revenue normally arises when a company offers net payment terms to its clients or consumers. In this scenario, if a company offers net-30 payment terms to all of its clients, a client can purchase an item on April 1 and is not required to pay until May 1. For the entire month of April, the company would record accrued revenue, and then it would create an adjusting entry in May to account for the payment. Profit is a financial benefit that is realized when the amount of revenue gained from a business activity exceeds the expenses, costs, and taxes needed to sustain the activity.